- Sep 15, 2021

The global cardiovascular device market is undergoing rapid technical improvements, owing to an increase in the challenging cardiology sector. Hence, the opportunities for cardiovascular medical device manufacturers is surging. Effective and innovative medical devices must be developed and deployed to go with the cardiology medical device market trend.

As the demand for cardiovascular medical devices expands, countries around the world must implement cost-effective solutions. A crucial aspect of these demand is the development and deployment of effective and innovative medical devices. According to Global Market Insights, Inc., it is predicted to contribute to the growth of the cardiovascular devices market, which is expected to surpass $10 billion by 2027.

The Drift towards Minimally Invasive Treatment Solutions

In recent years, minimally invasive procedures have gained immense popularity due to a plethora of benefits, such as a lower chance of complications, less pain, and less body damage. The development of cardiovascular devices has been driven by a global demand for less invasive medical procedures and treatments with excellent efficacy.

Innovations in cardiovascular medical device technologies are driving the choice for minimally invasive therapies. Since they depend solely on the use of catheters and other highly sophisticated medical equipment for therapeutic treatments and diagnostic assessments that is implanted into the body through small incisions, these advancements are instrumental in placing less invasive procedures as the operating method of choice.

Electronics, sensors, and mechanisms are included in new technologies such as smart balloon catheter systems. They are always being redesigned in order to provide ablation therapy, blood flow data, hematological data, and electrical stimulation all in one device.

This surging interest in minimally invasive procedures is compelled by the development of cardiovascular medical device technologies. These advancements are critical in promoting less invasive procedures as the favored operating method due to the fact that they predominantly use catheters and other specialized medical tools to be placed inside the body through tiny incisions, whether for diagnostic measurements or therapeutic interventions.

The United States influences the cardiovascular devices market because of the high pervasiveness of cardiovascular diseases, the high adoption rate of minimally invasive procedures, the presence of reimbursements, the rising geriatric population, and the high demand for continuous and home-based monitoring.

COVID-19 Patients and the Surging Risk of Atrial Fibrillation

While early publications concentrated on the respiratory effects of COVID-19, recent research has begun to shed light on a variety of heart-related issues that occur in about 10–20 percent of COVID-19 patients hospitalized, the most common of which is atrial fibrillation. According to a study headed by University of Pennsylvania researchers, COVID-19 patients admitted to the ICU, for example, were 10 times more likely to develop significant heart arrhythmias. Atrial fibrillation, especially, was observed in almost 19–21 percent of all COVID-19 cases.

This has highlighted the growing necessity of cardiovascular medical devices as crucial therapy solutions for emergent heart-related disorders during the pandemic. Major companies like Medtronic are working hard to meet the demand for advanced cardiac devices.

The Evolution of Innovative and Sophisticated Cardiac Ablation Devices

As the global burden of cardiovascular disease continues to rise over the years, the adoption of innovative treatment methods will experience a significant upsurge, creating lucrative development opportunities for the cardiovascular device sector in the years ahead.

According to GMI forecasts, cardiac ablation devices accounted for over 72 percent of the cardiovascular devices market share are expected to grow significantly in the upcoming years. The increased prevalence of atrial fibrillation is a significant factor in the device’s popularity.

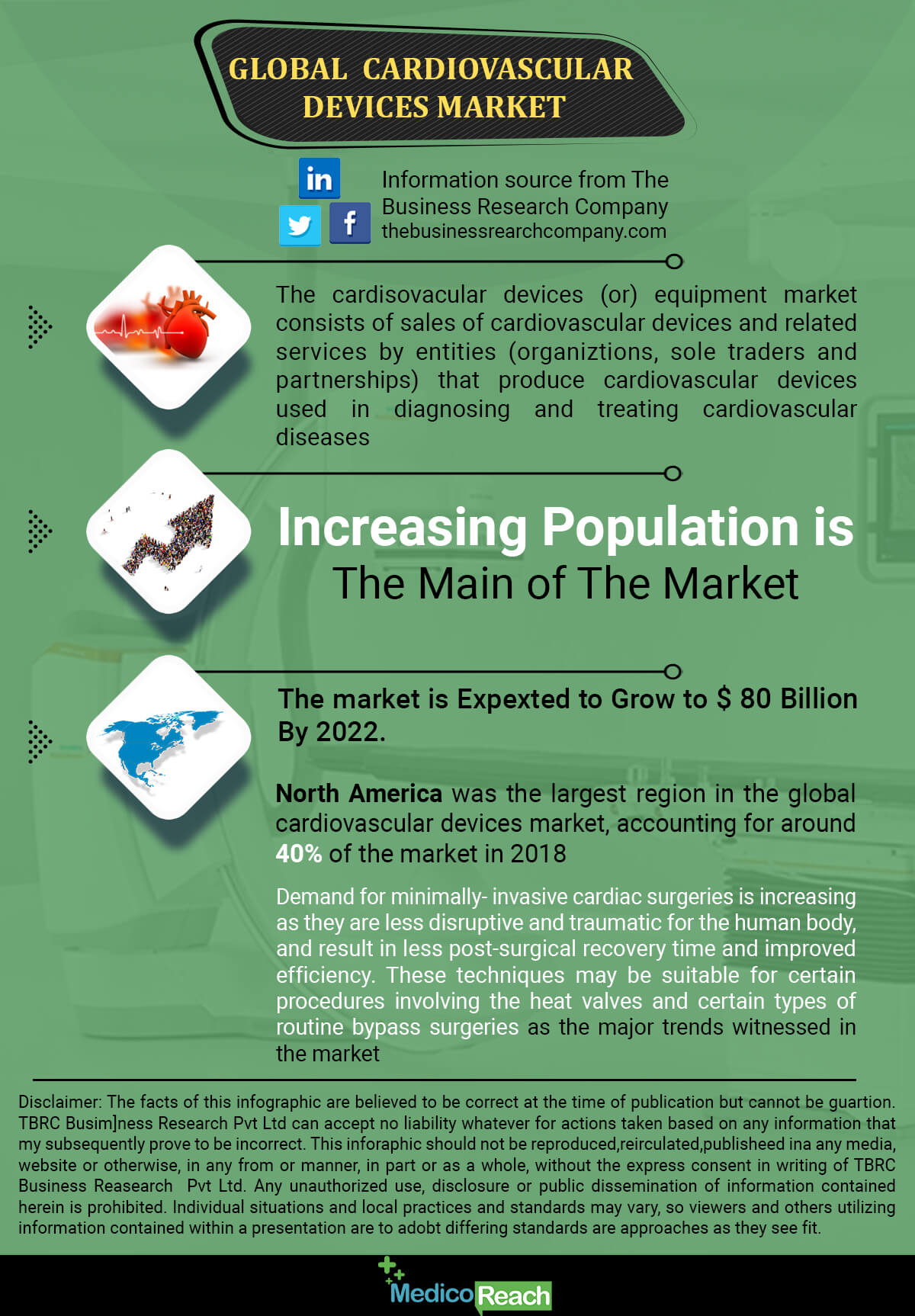

Market Overview

Due to increase in demand healthcare b2b marketers has a lot of opportunity to market the cardiology medical devices and services to cardiologists, hospitals etc. You can checkout our cardiologist email list to get the targeted contacts of cardiologists who are interested in your products.

The increase is primarily due to enterprises revamping their operations and recuperating from the impact of COVID-19, which had previously resulted in stringent containment measures such as social distancing, remote working, and the suspension of commercial activities, all of which created operational challenges. At a CAGR of 6 percent, the market is estimated to reach $66.15 billion in 2025.

The global cardiovascular devices market stretches into the regions of North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America has the largest market share for cardiovascular devices, followed by Europe. On the other hand, due to the rising prevalence of cardiovascular diseases and the market’s regulatory environment, the Asia Pacific market is expected to generate substantial cardiovascular device market revenue.

North America dominated the worldwide cardiovascular devices market in 2020, accounting for 37 percent of the market. The second largest region, Asia Pacific, accounted for 24 percent of the global cardiovascular devices market. In the global cardiovascular devices market, Africa was the smallest region. Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Cardinal Health Inc., and Edwards Life sciences are the leading competitors in the worldwide cardiovascular devices market.

The global cardiovascular devices market will grow at a 6.4 percent compound annual growth rate (CAGR) and Reach USD 82.20 Billion by 2026. According to Fortune Business Insights™, rising awareness and demand for cardiovascular surgical devices will drive market growth.

According to the report, the cardiovascular devices market was USD 49.90 billion in 2018 and is expected to grow at a CAGR of 6.4 percent between 2019 and 2026. Because of the rising number of occurrences of cardiovascular disorders, the global market is expected to reach USD 82.20 billion by 2026.

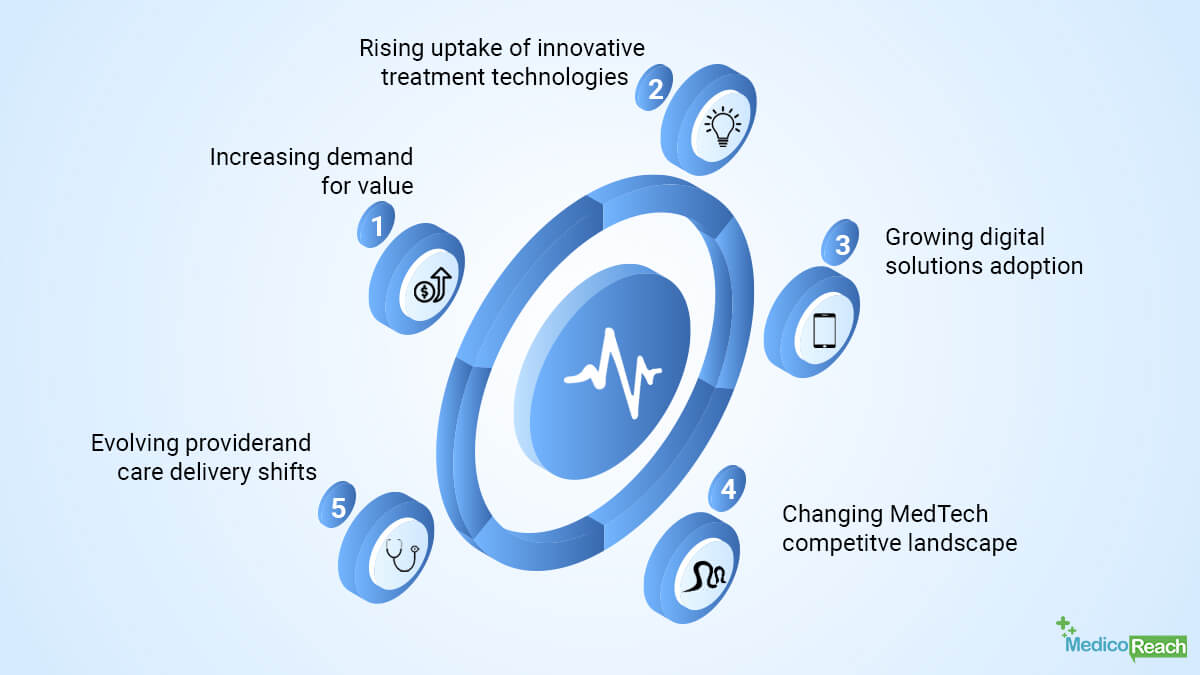

Five Market Trends Reshaping the CVD Market

Five broad health-care trends are transforming the CVD industry, impacting MedTech companies and their consumers both directly and indirectly. The five market trends impacting the cardiovascular landscape is listed in the below figure.

MedTech companies must now, more than ever, go to the heart of the changes taking place and review their strategies; how to effectively involve patients, providers, and payers, evolving competitors, as well as other stakeholders; and choose which strategies they should employ in order to prepare their companies for CVD success.

Wrapping Up

The apparent reinforcement of the cardiovascular devices industry is based on a major factor: the increased recognition of the risk of CVDs and related health concerns. The rapidly growing geriatric population will only add to the medical device industry’s potential. The market for cardiovascular devices is highly concentrated and competitive. The major firms have carved out niches for themselves in the industry. Furthermore, the enterprises compete in emerging markets with both global and local players. A number of the country’s major market players are developing new products and technologies to compete with existing ones, while others are acquiring and collaborating with other firms trending in the market.